Thinking about buying an RV but worried about the costs? You’re not alone.

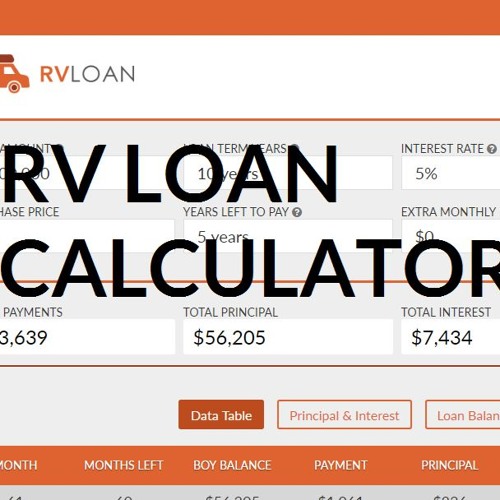

Understanding how much your monthly payments will be can make the whole process less stressful. That’s where an RV loan calculator comes in handy. It puts you in control, helping you see exactly what you can afford before you sign anything.

Keep reading to discover how this simple tool can save you money and time, making your dream RV purchase easier than ever.

Benefits Of Using An Rv Loan Calculator

An RV loan calculator offers many benefits for anyone planning to buy a recreational vehicle. It helps you understand your finances clearly. You can see how different loan terms affect your monthly payments. This tool makes the borrowing process less confusing and more manageable.

Using an RV loan calculator helps you make smarter decisions. It saves time and effort by showing instant results. You get a clear picture of what to expect before you apply for a loan.

Save Time And Effort

An RV loan calculator gives quick estimates. No need to call lenders or fill long forms. Just enter the loan amount, interest rate, and loan term. The calculator does the math in seconds. It helps avoid mistakes in manual calculations. Save hours by checking different scenarios fast.

Accurate Budget Planning

Plan your budget with confidence. The calculator shows monthly payments clearly. You see how loan length changes the payment size. It helps avoid surprises in your budget. Know exactly how much to set aside each month. This prevents financial stress later on.

Compare Loan Offers

Use the calculator to compare different loan deals. Enter rates and terms from various lenders. See which loan fits your budget best. This helps you choose the lowest cost option. Avoid costly loans by making side-by-side comparisons.

Key Factors Affecting Rv Loan Calculations

Understanding the key factors affecting RV loan calculations helps you plan your budget better. Each factor changes the total cost and monthly payments. Knowing these details makes the loan process clearer and less stressful.

Loan Amount

The loan amount is the total money you borrow to buy the RV. A larger loan means higher monthly payments. Smaller loans lower your monthly bills but may limit your RV choices.

Interest Rate

The interest rate is the cost of borrowing money from the lender. Higher rates increase your monthly payments and total loan cost. Lower rates save money and make payments easier to manage.

Loan Term

The loan term is the length of time to repay the loan. Longer terms lower monthly payments but increase total interest paid. Shorter terms mean higher payments but less interest overall.

Down Payment

The down payment is the upfront money paid when buying the RV. A bigger down payment reduces the loan amount. This lowers monthly payments and may help get better loan terms.

How To Use An Rv Loan Calculator

Using an RV loan calculator helps you plan your purchase. It shows how much you will pay each month. Also, it estimates the total cost of your loan. This tool makes choosing the right loan easier and faster.

Inputting Your Details

Start by entering the loan amount. This is the price of the RV minus any down payment. Next, add the interest rate. This rate affects how much extra you pay. Then, choose the loan term in months or years. Finally, include any fees if the calculator asks.

Interpreting Results

The calculator will show your monthly payment. It also displays the total interest paid over time. These numbers help you see if the loan fits your budget. Check if the monthly payment feels affordable. The total cost helps you compare loan options.

Adjusting Variables

Try changing the loan amount or term. See how a longer term lowers monthly payments. Watch how a shorter term raises them but cuts total interest. Adjust the interest rate to reflect different lenders. This lets you find the best loan deal for you.

Credit: www.amazon.com

Common Mistakes To Avoid With Rv Loans

Taking out an RV loan can help you enjoy the freedom of the open road. Yet, many people make avoidable mistakes during the process. These errors can lead to financial stress and trouble managing payments. Knowing the common pitfalls helps you use an RV loan calculator wisely and plan better.

Ignoring Additional Costs

Many focus only on the loan amount and monthly payments. They forget about extra expenses like insurance, maintenance, and registration fees. These costs add up fast and can strain your budget. Always include these in your calculations to avoid surprises later.

Overestimating Repayment Ability

It is easy to assume you can pay more than you truly can. Overestimating your repayment ability leads to missed payments and debt. Be realistic about your income and expenses. Use the RV loan calculator to test different payment options before deciding.

Skipping Credit Score Check

Your credit score affects your loan terms and interest rates. Skipping this step can cause higher costs or loan denial. Check your credit score early. Improving it can help you get better loan deals and save money.

Tips For Getting The Best Rv Loan

Getting a good RV loan can save you a lot of money. It also makes your payment plan easier to manage. Knowing some key tips helps you find the best loan deal. These tips help you make smart choices and avoid costly mistakes.

Shop Around For Rates

Compare loan offers from different lenders. Each lender sets its own interest rates. Even a small difference in rates affects your monthly payment. Visit banks, credit unions, and online lenders. Check their terms and fees. Choose the loan with the lowest cost overall.

Consider Loan Terms Carefully

Look at the length of the loan before signing. A longer loan means smaller monthly payments. But it also means paying more interest over time. Shorter loans cost less in interest but have higher monthly payments. Pick a loan term that fits your budget and financial goals.

Improve Your Credit Score

A higher credit score lowers your interest rate. Pay bills on time and reduce debt to raise your score. Check your credit report for mistakes and fix them. A better score helps you get better loan offers. It also saves you money on interest.

Credit: soundcloud.com

Credit: www.youtube.com

Frequently Asked Questions

What Is An Rv Loan Calculator Used For?

An RV loan calculator helps estimate monthly payments and total loan costs before buying.

How Do I Calculate My Monthly Rv Loan Payment?

Enter loan amount, interest rate, and term into the calculator to get monthly payments.

Can An Rv Loan Calculator Show Total Interest Paid?

Yes, it displays total interest paid over the loan period clearly.

Does The Calculator Include Taxes And Fees In The Estimate?

Most calculators do not include taxes or fees; check details for accuracy.

How Can An Rv Loan Calculator Help With Budgeting?

It helps plan your budget by showing affordable monthly payments.

Are Online Rv Loan Calculators Free To Use?

Yes, most online RV loan calculators are free and easy to access.

Conclusion

Using an RV loan calculator helps plan your budget clearly. It shows monthly payments and interest costs fast. You can compare loan options and find what fits best. This tool saves time and avoids surprises later. Try different numbers to see how they affect payments.

Understanding costs early makes buying an RV easier. Take control of your loan process today. Simple steps lead to smart decisions.